If the Overhead Rate Is Computed Annually

Predetermined Overhead Rate Formula Example 2. To avoid such fluctuations actual overhead rates could be computed on an annual or less-frequent basis.

Predetermined Overhead Rate Formula Calculator With Excel Template

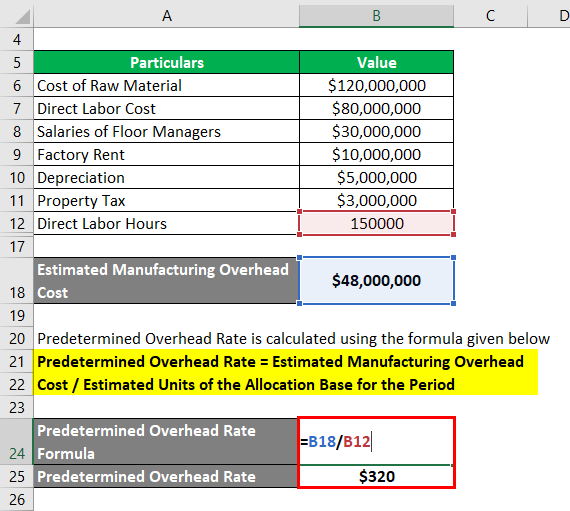

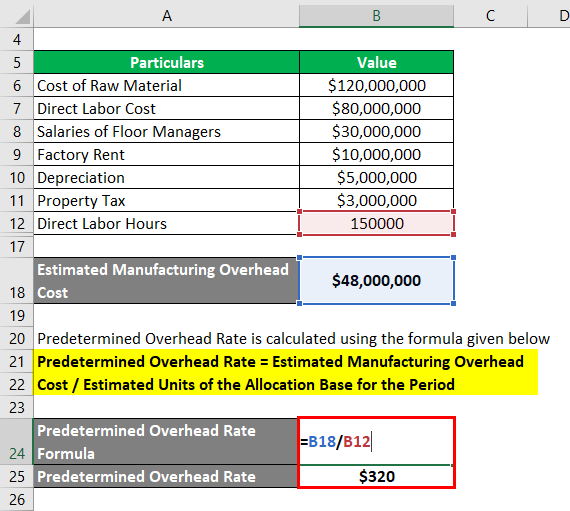

Using the above information we can compute the predetermined overhead rate as follows.

. If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed. If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed. A lower overhead rate indicates efficiency and more profits.

However if the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job would not be known until the end of the year. The amount of overhead applied to a particular job equals the actual amount of overhead caused by the job. Let us take the example of ort GHJ Ltd which has prepared the budget for next year.

Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. Truefalse false In a job-order cost system indirect labor is assigned to a job using information from the employee time ticket. If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed True or False True False.

For example the cost of Job 2B47 at Yost Precision Machining. TF False If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed. The company also estimated 508000 of fixed manufacturing overhead cost for the coming period and variable manufacturing.

11000 DLHs Predetermined overhead rate. 9 If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is. The pre-determined overhead rate is calculated before the period begins.

The predetermined overhead rate is computed as follows. Overhead rate 4 or 205 meaning that it costs the company 4 in overhead costs for every dollar in direct labor expenses. If a department estimates manufacturing overhead for the year will be 100000 and direct labor cost will be 400000 the predetermined overhead rate percentage is 25 100000400000.

Predetermined overhead rate Estimated manufacturing overhead costEstimated total units in the allocation base Predetermined overhead rate. To calculate the overhead rate divide the indirect costs by the direct costs and multiply by 100. Therefore the predetermined overhead rate of TYC Ltd for the upcoming year is expected to be 320 per hour.

If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed. Predetermined Overhead Rate 320 per hour. 257400 Estimated total direct labor hours DLHs.

45 46 The amount of overhead applied to a particular job equals the actual amount of overhead caused by the job. Compute the companys predetermined overhead rate for the year. For example if your overhead costs and billable hours average 10000 and 2000 per year respectively then your overhead rate is 10000 divided by 2000 or 5 per hour.

46 47 If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed. Predetermined Overhead Rate 48000000 150000 hours. At the beginning of the year it estimated that 35000 direct labor-hours would be required for the periods estimated level of production.

If your overhead rate is 20 it means the business spends 20 of its revenue on producing a good or providing services. If the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job can be. However if the overhead rate is computed annually based on the actual costs and activity for the year the manufacturing overhead assigned to any particular job would not be known until the end of the year.

Estimated total manufacturing overhead. Divide the annual overhead costs by the number of billable hours or production units to get the overhead cost per hour or per unit. - False - False Job-order costing systems often use allocation bases that do not reflect how jobs actually use overhead resources.

Cost per Hour The overhead rate can also be expressed. - True - True.

Predetermined Overhead Rate Formula Calculator With Excel Template

Solved Kunkel Company Makes Two Products And Uses A Chegg Com

Test Bank For Managerial Accounting 16th Edition By Garrison Ibsn 1259307417 By Baltzan111 Issuu

No comments for "If the Overhead Rate Is Computed Annually"

Post a Comment